Super Guarantee Rate Increase – Are You Ready?

As an employer, it is compulsory to pay your eligible employees super guarantee (SG) at least 4 times a year.

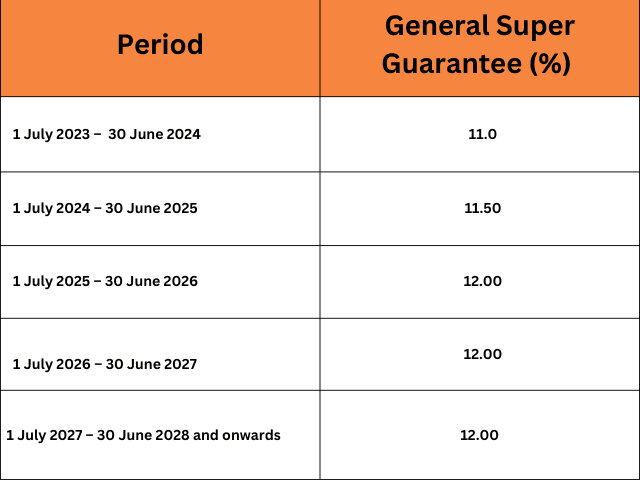

From 1 July 2024 the superannuation guarantee rate will increase from 11% to 11.5%.

The super guarantee charge (SGC) applies when employers don’t pay the minimum amount of super guarantee (SG) for their eligible employees to the correct fund by the due date.

The minimum SG is calculated as a percentage of each eligible employee’s earnings (ordinary time earnings) to a complying super fund or retirement savings account (RSA).

The super guarantee charge (SGC) applies when employers don’t pay the minimum amount of super guarantee (SG) for their eligible employees to the correct fund by the due date.

The minimum SG rate you must pay for each eligible employee is scheduled to progressively increase to 12% on 1 July 2025.

SG Contribution Quarters

Detailed information about the Super Guarantee changes can be found on the ATO Website